Bookkeeping Essentials for Small Service-Based Business Growth

Bookkeeping is a critical aspect of running a successful service-based business. Accurate and timely bookkeeping not only helps you stay organized and compliant but also provides valuable insights into your business's financial health. By mastering bookkeeping essentials, you can make informed decisions, plan for the future, and ultimately foster the growth of your service-based business.

In this comprehensive guide, we'll dive deep into the key elements of bookkeeping for service businesses, including setting up a chart of accounts, using bookkeeping software, tracking expenses, reconciling bank statements, and more. We'll also explore common bookkeeping mistakes to avoid and discuss the importance of accurate bookkeeping for making data-driven business decisions.

Whether you're just starting your service-based business or looking to improve your existing bookkeeping practices, this guide will provide you with the knowledge and tools you need to succeed.

Setting Up the Perfect Chart of Accounts

Setting up a chart of accounts is the foundation of effective bookkeeping. A chart of accounts is a list of all the financial accounts in your business's general ledger, including assets, liabilities, equity, income, and expenses. When creating your chart of accounts, tailor it to your specific service business to accurately reflect your financial transactions.

For example, if you run a consulting business, you might have accounts for "Consulting Income," "Travel Expenses," and "Office Supplies." By maintaining accurate accounts, you can easily track your income and expenses, generate financial reports, and make data-driven decisions for your business.

When setting up your chart of accounts, consider the following tips:

Use a numbering system to organize your accounts (e.g., 1000-1999 for assets, 2000-2999 for liabilities)

Create sub-accounts for more detailed tracking (e.g., "Consulting Income - Project A," "Consulting Income - Project B")

Align your accounts with your business structure and tax requirements

Review and update your chart of accounts regularly as your business grows and changes

By taking the time to set up a well-structured chart of accounts, you'll create a solid foundation for your bookkeeping practices and make it easier to track your financial performance over time.

Streamlining Your Service Business Bookkeeping with the Right Software

Using bookkeeping software can significantly streamline your financial management process. Bookkeeping software automates many tasks, reduces the risk of errors, and provides real-time financial data. When choosing bookkeeping software for your service business, look for features such as invoicing, expense tracking, bank reconciliation, and financial reporting.

Popular bookkeeping software options for service businesses include QuickBooks, Xero, and FreshBooks. These cloud-based solutions allow you to access your financial data from anywhere, collaborate with your team, and integrate with other business tools like payment processors and time-tracking apps.

When implementing bookkeeping software for your service business, consider the following best practices:

Choose software that aligns with your business needs and budget

Take advantage of training and support resources to ensure proper setup and use

Integrate your bookkeeping software with other tools to streamline data entry and reduce errors

Establish a routine for regularly updating and reconciling your financial data within the software

Use the software's reporting features to gain insights into your business's financial performance

By leveraging the power of bookkeeping software, you can save time, increase accuracy, and make more informed decisions for your service-based business.

Expert Tips for Service Business Expense Tracking

Tracking expenses is crucial for claiming tax deductions, monitoring your business's profitability, and creating accurate financial reports. As a service-based business, your expenses may include things like office rent, utilities, software subscriptions, marketing costs, and travel expenses.

To stay organized, categorize your expenses and establish a system for recording them regularly. You can use bookkeeping software to capture receipts, link your business credit card, and automatically categorize transactions. By diligently tracking your expenses, you'll be better prepared for tax season and can make informed decisions about where to allocate your resources.

Here are some tips for effective expense tracking:

Establish clear categories for your expenses (e.g., office supplies, travel, marketing)

Use bookkeeping software or a dedicated expense tracking app to record expenses in real-time

Digitize receipts and attach them to transactions in your bookkeeping software

Regularly review and categorize your expenses to ensure accuracy

Set up rules or automation within your bookkeeping software to automatically categorize recurring expenses

Analyze your expense data to identify areas for cost savings and optimization

By consistently tracking your expenses, you'll gain a clearer picture of your business's financial health and be better equipped to make strategic decisions for growth.

Regular Bank Reconciliation for Service-Based Businesses

Regular Bank Reconciliation

Bank reconciliation is the process of comparing your business's accounting records with your bank statement to ensure that they match. Regularly reconciling your bank statements helps you identify discrepancies, detect fraud, and maintain accurate financial records.

To reconcile your bank statement, compare each transaction in your accounting software with the corresponding transaction on your bank statement. Look for any discrepancies, such as missing or duplicate transactions, and make necessary adjustments. Aim to reconcile your bank statements at least once a month to catch any issues early on.

When reconciling your bank statements, follow these best practices:

Set aside dedicated time each month to perform reconciliations

Use your bookkeeping software's reconciliation features to streamline the process

Investigate and resolve any discrepancies promptly

Keep detailed records of reconciliations, including any adjustments made

Consider implementing a separation of duties, where one person handles bookkeeping and another performs reconciliations

Regularly review your bank statements for any unusual activity or unauthorized transactions

By consistently reconciling your bank statements, you'll maintain accurate financial records and quickly detect any issues that need to be addressed.

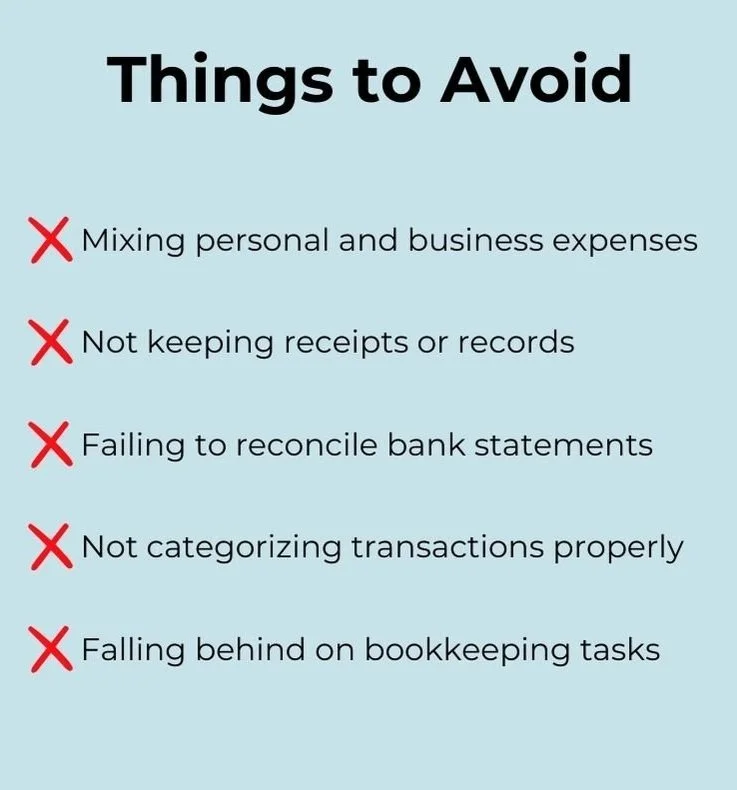

Bookkeeping Mistakes to Avoid

Even seasoned business owners can make bookkeeping mistakes, which can lead to financial inaccuracies, tax issues, and missed growth opportunities. Some common bookkeeping mistakes include:

To avoid these mistakes, establish clear bookkeeping processes, stay organized, and regularly review your financial records. If you're unsure about certain aspects of bookkeeping, consider working with a professional bookkeeper or accountant to ensure accuracy and compliance.

Here are some additional tips for avoiding bookkeeping mistakes:

Educate yourself and your team on proper bookkeeping practices

Implement checks and balances to catch errors and discrepancies

Regularly backup your financial data to prevent loss

Stay up-to-date with tax laws and regulations that impact your business

Conduct periodic internal audits to identify and correct any issues

Seek professional guidance when needed to ensure compliance and accuracy

By being proactive and diligent in your bookkeeping practices, you can avoid costly mistakes and set your service-based business up for long-term success.

The Importance of Bookkeeping for Service-Based Businesses

Accurate bookkeeping is essential for making informed business decisions. By having up-to-date financial records, you can:

Monitor your business's profitability

Identify areas for cost savings

Make data-driven decisions about pricing, hiring, and investments

Create realistic budgets and financial projections

Prepare for tax season and claim eligible deductions

In addition to supporting decision-making, proper bookkeeping is crucial for securing funding from investors or lenders. They will want to see organized financial statements that demonstrate your business's financial health and growth potential.

Here are some key ways that accurate bookkeeping can benefit your service-based business:

Cash flow management: By tracking your income and expenses, you can better manage your cash flow and ensure that you have sufficient funds to cover your obligations and invest in growth.

Pricing strategy: Accurate bookkeeping data can help you determine the true cost of delivering your services, allowing you to set profitable prices and make informed decisions about pricing changes.

Business planning: With clear financial records, you can create realistic budgets, set financial goals, and develop strategic plans for your business's future.

Tax preparation: Accurate bookkeeping throughout the year simplifies tax preparation and ensures that you claim all eligible deductions, minimizing your tax liability.

Investor and lender confidence: Well-organized financial statements demonstrate your business's financial health and growth potential, making it easier to secure funding from investors or lenders.

By recognizing the importance of accurate bookkeeping and making it a priority in your service-based business, you'll be better positioned to make informed decisions, plan for the future, and achieve your growth objectives.

Tax Prep Tips for Service-Based Businesses

Keeping your books up-to-date throughout the year will make tax preparation much smoother. As a service-based business, you may be eligible for various tax deductions, such as:

Home office deduction

Vehicle expenses

Depreciation of equipment

Professional development and education costs

Marketing and advertising expenses

To prepare your books for tax season:

Ensure all transactions are categorized correctly

Reconcile your bank statements

Review your financial reports for accuracy

Gather necessary documentation, such as receipts and invoices

Consult with a tax professional to identify deductions and ensure compliance

Here are some additional tips for effective tax preparation:

Stay informed about tax law changes and updates that impact your business

Keep detailed records of all business expenses, including receipts and invoices

Consider using tax preparation software or working with a tax professional to ensure accuracy and maximize deductions

Plan ahead for tax payments by setting aside funds throughout the year

File your taxes on time to avoid penalties and interest charges

Keep tax records and supporting documentation for at least three years in case of an audit

By staying organized and proactive in your tax preparation efforts, you can minimize your tax liability, avoid costly mistakes, and ensure compliance with all relevant tax laws and regulations.

Bookkeeping Options for Growing Service Businesses

As your service-based business grows, you'll need to decide whether to handle bookkeeping in-house or outsource it to a professional. In-house bookkeeping gives you more control over your financial data and can be cost-effective for smaller businesses. However, it also requires time and expertise to ensure accuracy and compliance.

Outsourcing bookkeeping to a professional or firm can save you time and provide peace of mind knowing that your books are being handled by an expert. When choosing a bookkeeping service, consider factors such as their experience with service-based businesses, technology stack, and communication style.

Here are some pros and cons to consider when deciding between in-house and outsourced bookkeeping:

In-house bookkeeping:

Pros: More control over financial data, can be cost-effective for smaller businesses, immediate access to financial information

Cons: Requires time and expertise, may be challenging to keep up with changing regulations, can be difficult to scale as the business grows

Outsourced bookkeeping:

Pros: Saves time, ensures accuracy and compliance, provides access to specialized expertise, can scale with the business

Cons: Less control over financial data, can be more expensive than in-house bookkeeping, may have communication challenges

Ultimately, the best bookkeeping option for your service-based business will depend on your specific needs, resources, and growth objectives. Consider your current financial situation, future goals, and the level of expertise and control you require when making your decision.

Data-Driven Decision Making: Utilization of Bookkeeping Insights

Bookkeeping data provides valuable insights that can guide your business decisions. By regularly reviewing key financial reports and metrics, you can:

Monitor cash flow and adjust spending accordingly

Identify trends in revenue and expenses

Evaluate the profitability of different services or projects

Make informed decisions about pricing, hiring, and resource allocation

Some essential reports to review include:

Profit and Loss Statement (P&L)

Balance Sheet

Cash Flow Statement

Accounts Receivable Aging Report

Accounts Payable Aging Report

By analyzing these reports, you can gain a comprehensive understanding of your business's financial performance and make data-driven decisions to support growth.

Here are some examples of how bookkeeping data can inform your business decisions:

Pricing: By analyzing your profit margins and cost of delivering services, you can determine if your current pricing is sufficient or if adjustments are needed to improve profitability.

Hiring: Reviewing your revenue growth and cash flow can help you decide if it's the right time to hire additional staff or contractors to support your business's growth.

Investments: Examining your financial statements can help you identify opportunities for investment, such as purchasing new equipment or expanding your service offerings.

Cost reduction: Analyzing your expenses can reveal areas where you can cut costs or negotiate better deals with vendors to improve your bottom line.

Marketing: Tracking the return on investment (ROI) of your marketing efforts can help you allocate your marketing budget more effectively and focus on the channels that generate the most leads and revenue.

By regularly reviewing your bookkeeping data and using it to inform your decision-making, you can make strategic choices that drive the growth and success of your service-based business.

Staying on Top of Your Finances: Essential Bookkeeping Tasks

To stay on top of your bookkeeping, establish a routine for daily, weekly, and monthly tasks. Here's a sample bookkeeping checklist:

Daily:

Record transactions

File receipts and invoices

Check cash balance

Weekly:

Reconcile transactions with bank statements

Send invoices and follow up on outstanding payments

Review and categorize expenses

Monthly:

Reconcile bank and credit card statements

Review monthly financial reports

Analyze budget vs. actual spending

Prepare and submit sales tax (if applicable)

By breaking down bookkeeping tasks into manageable chunks, you can ensure that your books stay up-to-date and accurate.

Here are some additional tips for maintaining accurate and timely bookkeeping:

Set aside dedicated time for bookkeeping tasks, and treat them as a priority

Use bookkeeping software to automate and streamline processes

Establish clear policies and procedures for financial transactions, such as expense reporting and invoice approval

Train your team on proper bookkeeping practices and ensure they understand their roles and responsibilities

Regularly communicate with your bookkeeper or accountant to address any issues or concerns

Continually review and optimize your bookkeeping processes to improve efficiency and accuracy

By establishing a clear bookkeeping routine and following best practices, you can minimize errors, save time, and ensure that your financial records are always up-to-date and ready to support your business decisions.

From Balancing Books to Thriving Business

By consistently maintaining accurate books, analyzing financial data, and using it to guide your decision-making, you'll be well-positioned to achieve your business goals and thrive in the competitive world of service-based businesses.

Remember, bookkeeping is not just a tedious task to cross off your to-do list – it's a strategic tool that can help you unlock the full potential of your service-based business. By dedicating time and resources to mastering your books, you'll gain invaluable insights into your financial performance, empowering you to make data-driven decisions that propel your business forward. With a solid bookkeeping foundation, you'll be unstoppable in achieving your business goals and realizing your entrepreneurial dreams.