Choosing the Right Bookkeeping Software for Your Service-Based Business

Disclaimer: This content is for informational purposes only and does not constitute professional accounting advice. As a CPA, I recommend consulting with a qualified accounting professional before making financial decisions for your business. Individual circumstances may vary.

As a service-based business owner, you understand the crucial role that bookkeeping plays in managing your finances and driving your business's success. However, manual bookkeeping processes can be time-consuming, error-prone, and inefficient. That's where bookkeeping software comes in – the right tool can streamline your financial management, saving you time and money while providing valuable insights into your business's performance.

In this blog post, we'll explore how to choose the best bookkeeping software for your service-based business. We'll cover key features to look for, popular software options, and tips for evaluating and implementing your chosen solution. By the end of this article, you'll be well-equipped to make an informed decision and take your bookkeeping to the next level.

Assessing Your Service-Based Business's Bookkeeping fNeeds

Before diving into software options, it's essential to assess your business's specific bookkeeping needs. Start by identifying your current bookkeeping challenges. Are you struggling with manual data entry? Do you have trouble tracking expenses or generating invoices? Understanding your pain points will help you prioritize the features you need in a bookkeeping solution for serviced-based businesses.

Next, consider the essential features for your service business. Some common requirements include:

Invoicing and billing capabilities

Expense tracking and categorization

Financial reporting and analysis

Integration with other business tools, such as payment processors or time tracking software

Finally, think about your business size and growth plans. Choose a bookkeeping software that can scale with your business, offering features and pricing plans that accommodate your current needs and future growth.

Key Features to Look for in Bookkeeping Software

When evaluating bookkeeping software options, there are several key features to consider:

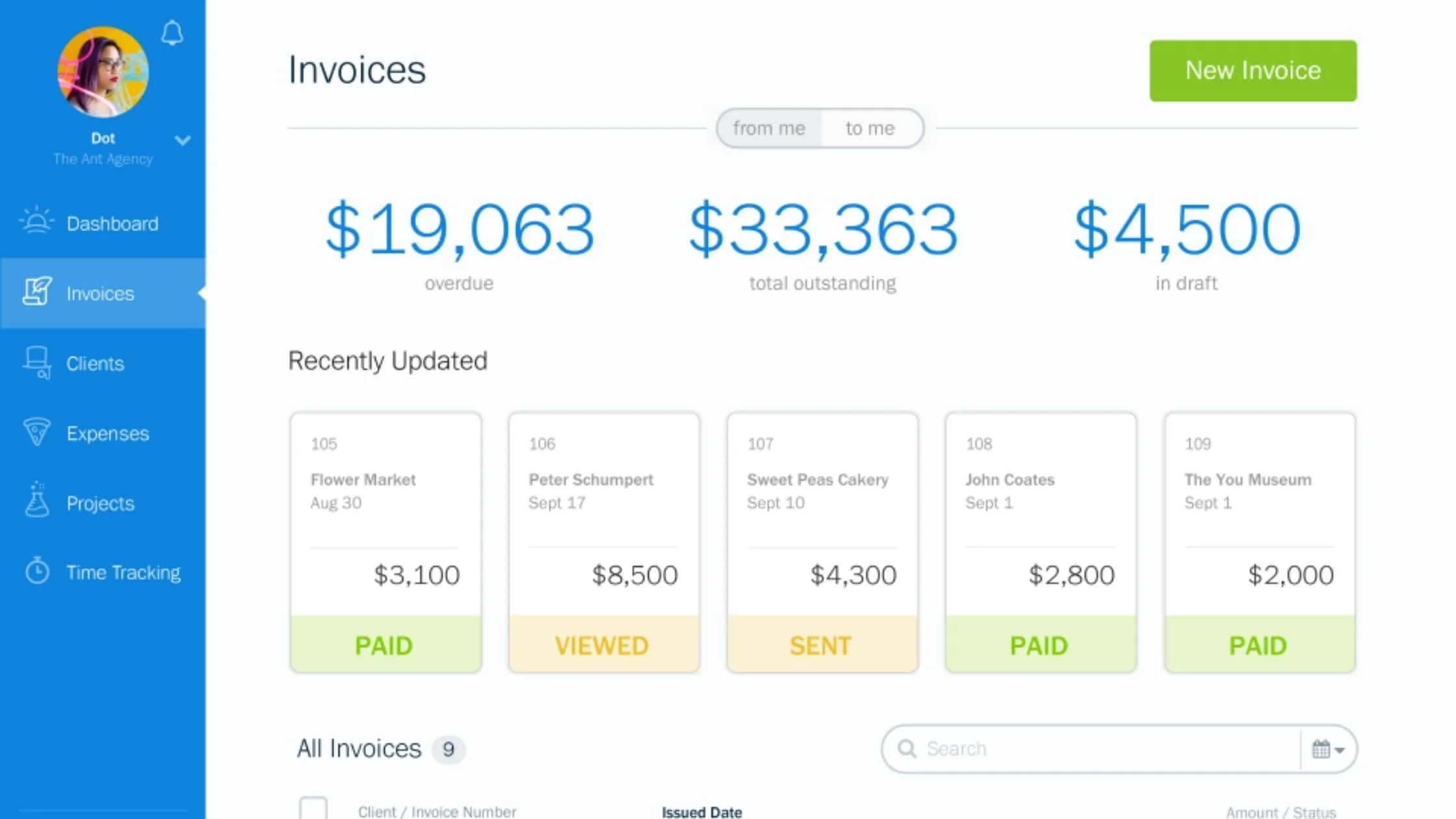

Invoicing and billing capabilities: Look for software that allows you to easily create, send, and track invoices. Customizable templates, automatic payment reminders, and online payment options can streamline your billing process.

Expense tracking and categorization: Choose a solution that simplifies expense management, allowing you to capture receipts, categorize expenses, and track billable hours or project costs.

Bank and credit card reconciliation: Automatic bank feed updates and reconciliation features can save you time and ensure accuracy by matching transactions with your records.

Financial reporting and analysis: Robust reporting capabilities, such as profit and loss statements, balance sheets, and cash flow projections, provide valuable insights into your business's financial health.

Integration with other business tools: Look for software that integrates with the tools you already use, such as payment processors, time tracking apps, or CRM systems, to avoid manual data entry and ensure a seamless workflow.

Don't guess with your bookkeeping software choice. Schedule a consultation to get expert advice tailored to your service’s needs.

Cloud-Based vs. Desktop Bookkeeping Software

When choosing bookkeeping software, you'll need to decide between cloud-based and desktop solutions. Cloud-based software, also known as Software as a Service (SaaS), is hosted on remote servers and accessed via the internet. Desktop software, on the other hand, is installed locally on your computer.

For most service-based businesses, cloud-based bookkeeping software offers several advantages:

Accessibility: Cloud-based software allows you to access your financial data from anywhere with an internet connection, making it easy to collaborate with your team or accountant.

Automatic updates: With cloud-based solutions, software updates and security patches are applied automatically, ensuring you always have access to the latest features and improvements.

Scalability: Cloud-based software can easily scale with your business, offering different pricing plans and features to accommodate your growing needs.

Data backup and security: Reputable cloud-based providers invest heavily in data security and backup measures, protecting your financial information from loss or unauthorized access.

However, there may be situations where desktop software is preferred, such as when internet connectivity is limited or when you require specific customizations that aren't available in cloud-based solutions. Consider your business's unique needs and infrastructure when making this decision.

Popular Bookkeeping Software Options for Service-Based Businesses

There are several well-known bookkeeping software options tailored to the needs of service-based businesses. Some popular choices include:

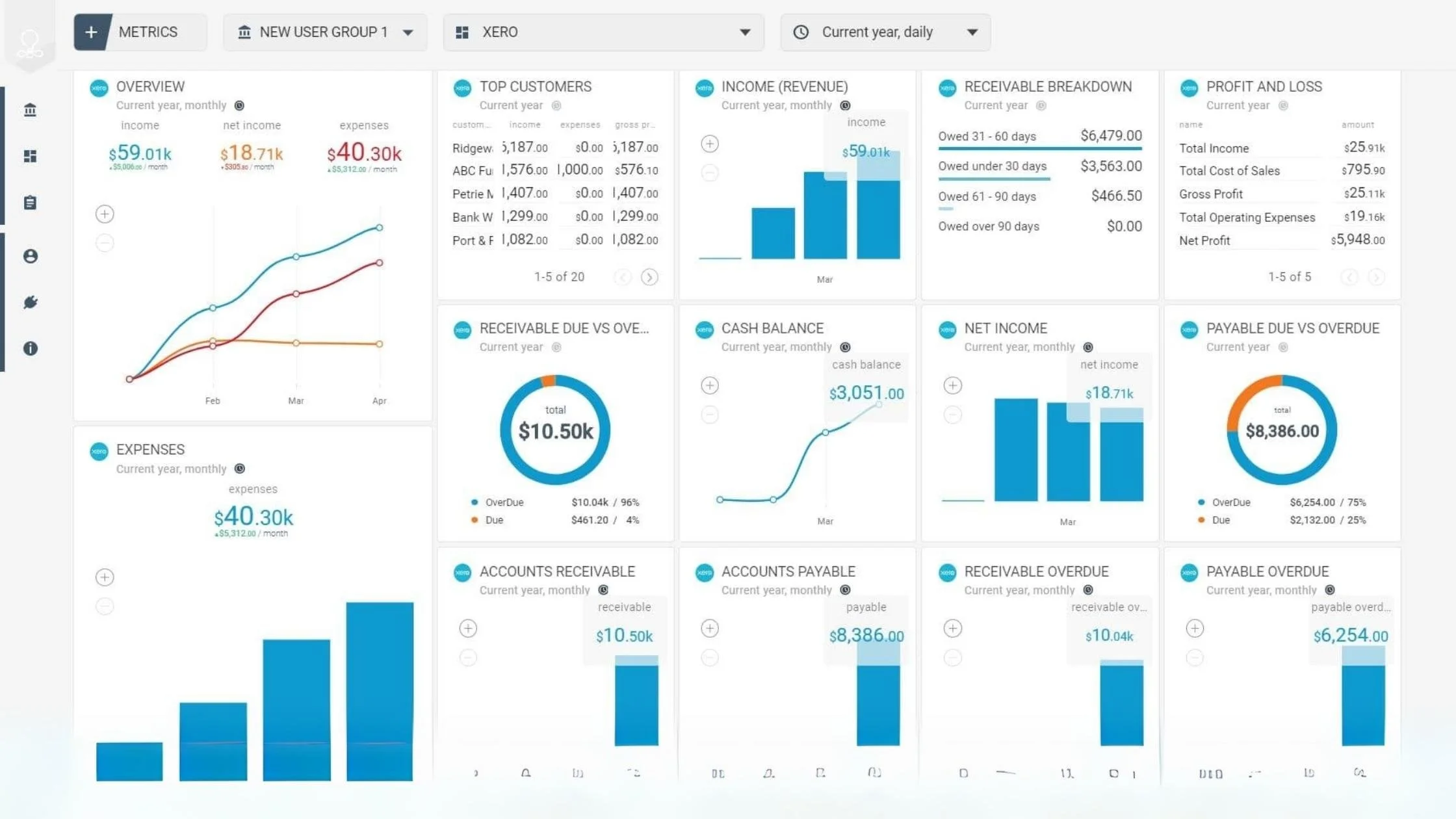

Key features: Comprehensive financial management, invoicing, expense tracking, time tracking, and robust reporting.

Benefits: User-friendly interface, wide range of integrations, and strong reputation in the industry.

Pricing: Plans start at $25/month, with options for different business sizes and needs.

Key features: Intuitive interface, unlimited users, invoicing, expense management, and inventory tracking.

Benefits: Strong mobile app, extensive integration options, and real-time financial reporting.

Pricing: Plans start at $11/month, with options for growing businesses.

Key features: Time tracking, project management, invoicing, expense tracking, and client collaboration.

Benefits: User-friendly interface, excellent customer support, and well-suited for service-based businesses.

Pricing: Plans start at $15/month, with options for different team sizes and features.

Key features: Accounting, invoicing, receipt scanning, and payment processing.

Benefits: Free accounting and invoicing features, with additional paid services available for payment processing and payroll.

Pricing: Accounting and invoicing are free, with competitive transaction fees for payments and payroll services.

Evaluating and Comparing Bookkeeping Software

With multiple bookkeeping software options available, it's essential to carefully evaluate and compare your top choices before making a decision. Here are some tips to help you assess potential solutions:

Try free trials or demos: Many bookkeeping software providers offer free trials or demos, allowing you to explore the features and interface firsthand.

Assess user-friendliness and learning curve: Choose software with an intuitive interface and user experience, minimizing the time and effort required to learn and use the system effectively.

Read user reviews and testimonials: Seek out feedback from other service-based businesses to gauge the real-world performance and customer support of each software option.

Consider customer support and resources: Look for providers that offer robust customer support, including live chat, phone support, and extensive knowledge bases or training materials.

Compare pricing plans and value for money: Evaluate the features and limits of each pricing tier, and choose a plan that offers the best value for your business's needs and budget.

Implementing and Transitioning to New Bookkeeping Software

Once you've chosen your bookkeeping software, it's time to implement it and transition your financial data. Here are some tips to ensure a smooth process:

Prepare your data for migration: Clean up your existing financial records and ensure that your data is organized and ready for import into the new system.

Train yourself and your team: Dedicate time to learning the new software, utilizing training resources and support provided by the vendor. Ensure that all team members who will use the software are comfortable with its features and processes.

Integrate with other business tools: Connect your bookkeeping software with other tools you use, such as payment processors, time tracking apps, or invoicing systems, to streamline your workflow and avoid manual data entry.

Monitor and evaluate the effectiveness: Regularly assess the performance of your new bookkeeping software, tracking metrics such as time saved, accuracy improvements, and financial insights gained. Continuously look for ways to optimize your use of the software and integrate it into your business processes.

Related Article: Setting Up a Service-Based Business Chart of Accounts

Choose and Implement the Perfect Bookkeeping Software

Choosing the right bookkeeping software is a critical decision for service-based businesses looking to streamline their financial management and drive growth. By assessing your business's unique needs, evaluating key features, and comparing popular options like QuickBooks, Xero, FreshBooks, and Wave, you can find a solution that fits your requirements and budget.

Remember, the right bookkeeping software can save you time, reduce errors, and provide valuable financial insights to inform your business decisions. Take the time to research and compare your options carefully, and don't hesitate to take advantage of free trials or demos to find the best fit for your service-based business.

By embracing the power of bookkeeping software, you'll be better equipped to manage your finances effectively, make data-driven decisions, and achieve your business goals. Start your journey towards bookkeeping success today!

Don't guess with your bookkeeping software choice. Schedule a consultation to get expert advice tailored to your service’s needs.